Huahe Carbon Technology Co., Ltd

Shenzhen Huahe Carbon Technology Co., Ltd. (hereinafter referred to as the Company) is a holding subsidiary of listed company Huapengfei and a leading value promoter in the field of carbon neutrality and low-carbon development in China. The company focuses on dual carbon products and focuses on carbon asset management and green consulting. It provides one-stop solutions for carbon one solutions, including carbon asset custody, carbon quota (CEA) consulting, development and trading of certified voluntary emission reductions (CCER) and certified emission reduction standards (VCS), establishment and training of carbon management systems and systems, ESG comprehensive services, and other COS (Carbon One Solution) solutions. It also cooperates strategically with well-known domestic and foreign carbon industry professional institutions such as TUV, Baocarbon, and Zhongchuang Carbon Investment to fully promote green and low-carbon development of government and enterprises, and serve to promote comprehensive green transformation of economic and social development.

The Development History of China's Carbon Market

2011

The National Development and Reform Commission has designated Beijing, Shanghai, Guangdong, Shenzhen, Hubei, Chongqing, and Tianjin as pilot cities for carbon emission trading.

2012

Seven pilot provinces and cities will study and formulate carbon trading pilot plans.

The National Development and Reform Commission proposes to verify the voluntary emission reduction (CCER) trading to determine the principle of national voluntary emission reduction trading.

2013

Seven carbon trading pilot projects have been launched successively: Shenzhen, Shanghai, Beijing, Guangdong, Tianjin, Hubei, and Chongqing.

2017-2020

The construction of the national carbon market will be carried out, and regulations related to the initial allocation of carbon quotas (CEAs), fixed markets, and trading will be implemented.

The construction of the national carbon market trading system and registration system has been completed.

The Hong Kong Stock Exchange has disclosed the ESG Reporting Guidelines, which require listed companies in Hong Kong to explain why they do not disclose ESG information.

2021-present

The construction of the national carbon market will be carried out, and regulations related to the initial allocation of carbon quotas (CEAs), fixed markets, and trading will be implemented.

The construction of the national carbon market trading system and registration system has been completed.

The Hong Kong Stock Exchange has disclosed the ESG Reporting Guidelines, which require listed companies in Hong Kong to explain why they do not disclose ESG information.

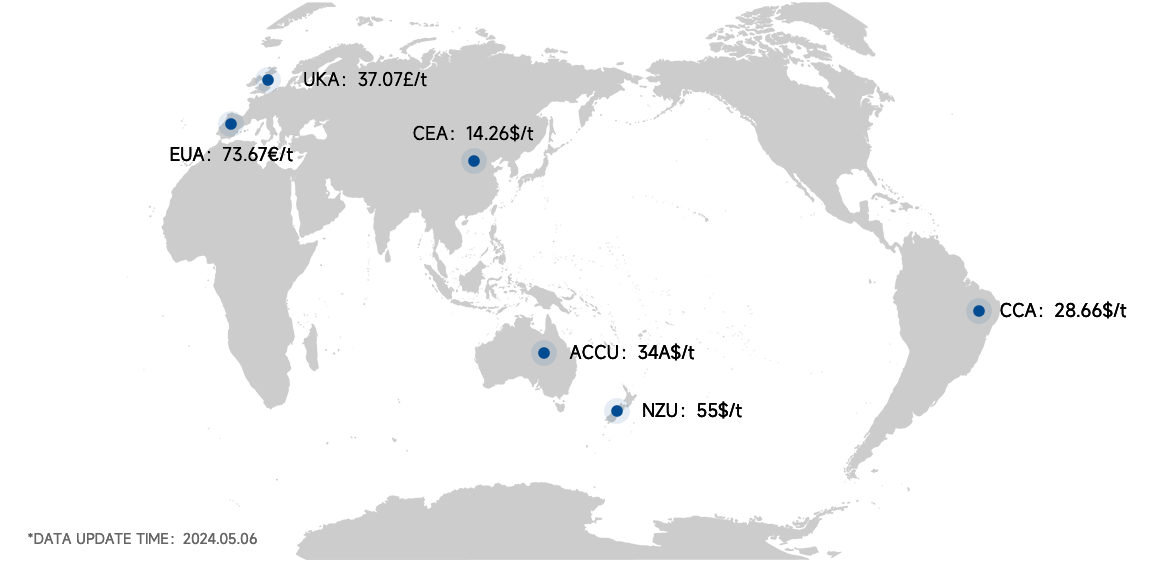

China's carbon price is severely undervalued

After the financialization of China's carbon market, with a quota of 7-8 billion tons, it can reach 5 times the current quota of the EU carbon market; With the gradual financialization of transaction volume, it is possible to exceed 50-60 billion tons, with a unit price possibly exceeding 200 yuan and a transaction amount possibly exceeding 10 trillion yuan.

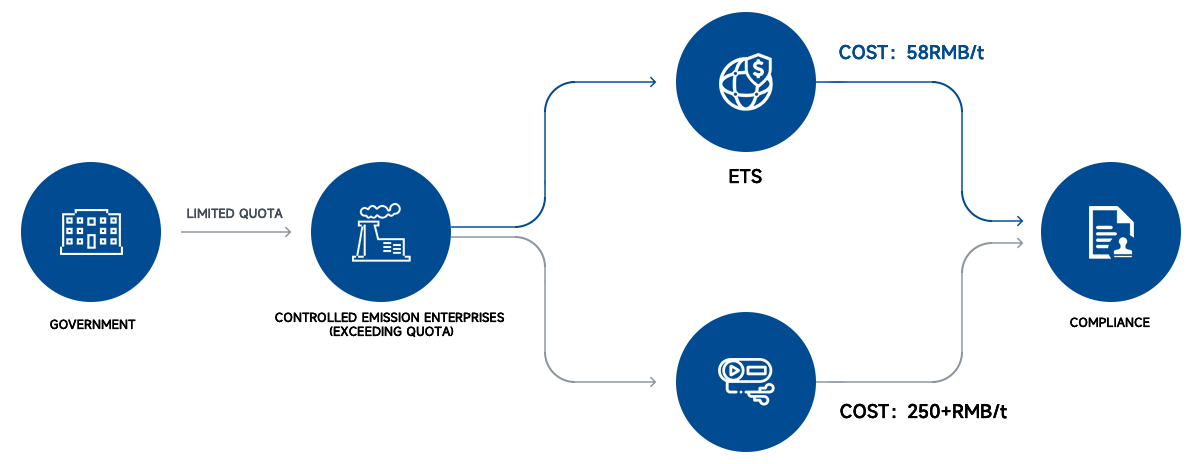

Carbon trading provides enterprises with lower cost carbon neutrality options

Carbon asset management

The main service enterprises purchase to offset emissions exceeding national control (standard market), or to meet conscious enterprises' voluntary emission reduction commitments (non-standard market).

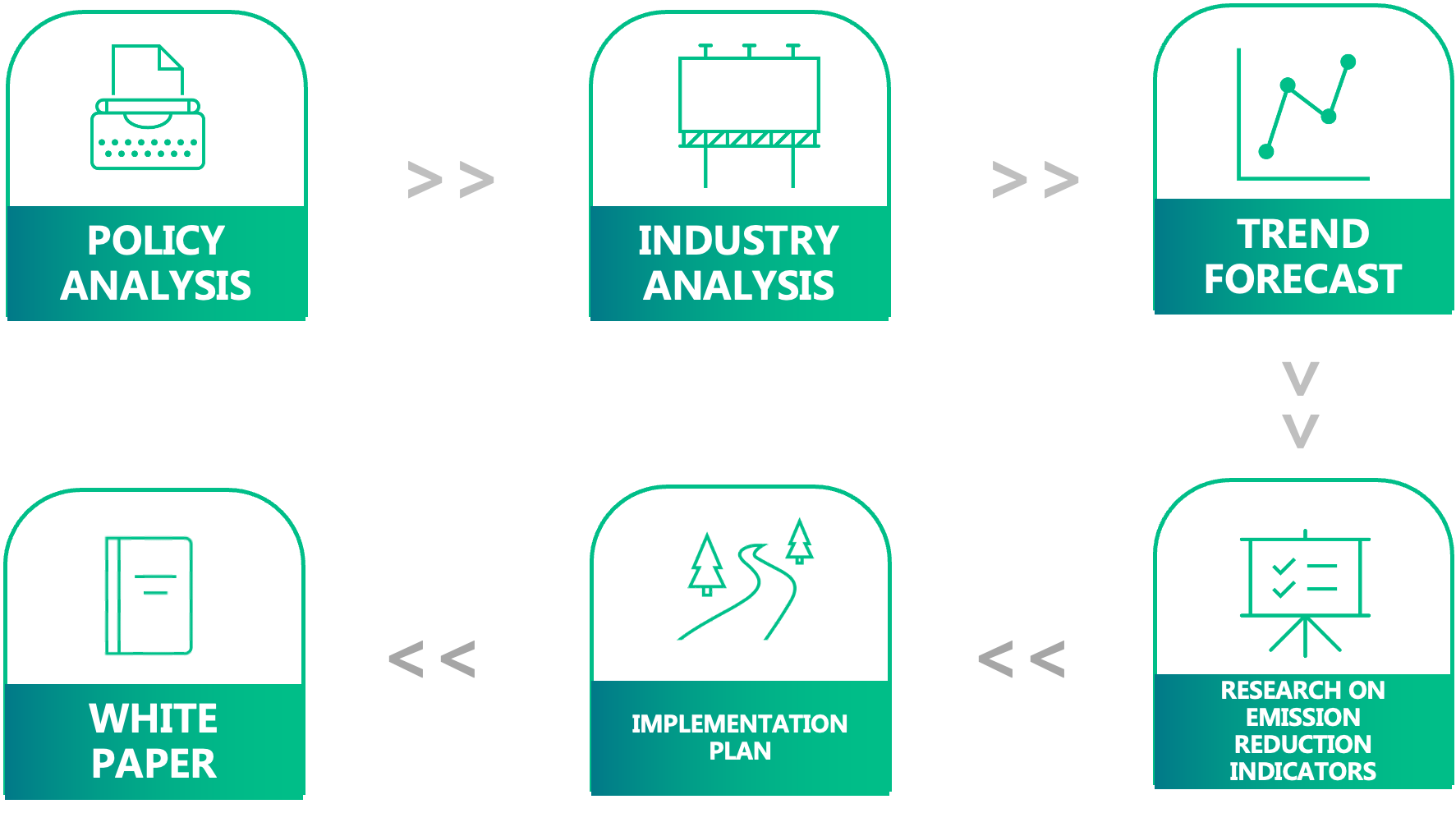

"Dual carbon" planning and consulting

- Government agencies

- Enterprise unit

"Dual carbon" training

Practice of Enterprise Carbon Emission Accounting and Verification

Carbon inventory checks to understand one's own carbon background, ensure the accuracy of carbon emission data, effectively respond to various national carbon verification work, and actively participate in the national carbon market.

Carbon market mechanism and corporate carbon management

Understand the latest national strategic policies and the overall thinking of the national carbon market, master the principles of carbon trading mechanisms, understand our own carbon background, establish an internal carbon asset management system, and timely seize carbon opportunities.

Carbon Neutrality Pathway and Offset Market

Understand the development situation of domestic and international carbon markets and offset mechanisms, enhance the professional abilities of relevant personnel in emission reduction project development, measurement and trading, seize the strategic opportunities of offset market development, fully participate in the national carbon market, and help enterprises achieve their carbon neutrality goals.

Carbon finance and green finance

Grasp the development trend of green finance, innovate carbon markets and low-carbon industry chain investment and financing services, improve the ability of enterprises to formulate and implement energy-saving and carbon reduction strategies, avoid market risks, broaden funding channels and improve investment efficiency, and achieve sustainable development.

ESG Sustainable Development Integrated Services

Sustainable development strategy planning

By controlling the current situation and empowering the leadership, and implementing organizational change and personnel participation based on established paths, strategic execution is integrated into the practice of the entire business system, helping enterprises build an organic system for sustainable development.

Information Disclosure and Report Preparation

Assist enterprises in accurately positioning their ESG development needs by sorting out and comparing ESG information disclosure requirements or ESG evaluation systems, creating a unique brand story for the enterprise, and introducing ESG issues into enterprise management to assist in high-quality development of the enterprise.

Impact rating management

There is a tracking and management process for corporate social responsibility rating, which endows the enterprise with higher value creation and integration with business culture, and fundamentally improves ESG indicators and ratings such as MSCI, DJSI, CDP, and FTSE Russell, meeting the attention and expectations of investors for the company's ESG.

Digital services

Using the "Low Carbon Home" mini program as a link, assist enterprises in creating various hybrid collaboration methods based on ESG, strengthen ESG performance and business scenario management, carbon inclusive systems, supply chain collaboration, and establish risk monitoring mechanisms to enhance the overall ESG management level of enterprises.

Core advantages

Financial strength

Financial strength

The strong financial strength of listed companies Smooth financing channels.

Professional team

Professional team

The core team of Huahe Carbon Technology is one of the world's first leaders to enter the domestic and international carbon markets. Since 2006, I have been deeply involved in the industry for decades, familiar with global carbon market trading rules, and have rich experience in carbon credit product development, carbon trading, and carbon management.

Industry chain services

Industry chain services

The group system enterprise has a Class A surveying and mapping qualification, deeply cultivates geographic information technology, and provides services to government units such as land, forestry, natural resources, and animal husbandry year-round. At the same time, we will collaborate deeply with leading experts/enterprises in the industry ecosystem to form an industry chain service alliance.

Our partners

- Ranking is not in any particular order